What is Universal Credit?

Universal Credit is a benefit for working age people. It is made up of living money for bills, food, clothes and the housing costs money for rent.

- You can be both in and out of work when claiming it.

- How much you receive depends on your individual circumstances, including what other incomes/wages you might have.

- Payments are made as one monthly amount. You will be responsible for paying your monthly bills (including rent) out of this monthly figure.

- Universal Credit can support housing costs (rent + service charges) if you pay rent as a tenant or shared owner.

You can check your entitlement to Universal Credit and other benefits here:

For assistance with applying to Universal Credit, you can use our step-by-step guidance below:

Good things to know about Universal Credit

- Payments are made as one monthly amount. You will be responsible for paying your monthly bills (including your rent) out of this monthly figure.

- When you claim Universal Credit, your old living money benefits will stop and there is a wait time of 5 weeks before you receive your first UC payment. You can apply for a living allowance from Universal credit to help you.

- You can have your Universal Credit paying split into two smaller payments instead across the month.

- You can have housing costs for rent paid directly to NHG (as with old Housing Benefits claims)

- Once you claim, you will need to make sure you check your phone or email regularly for updates and for messages from your case manager.

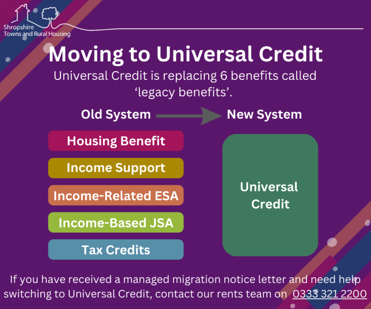

Moving to Universal Credit

- If you still receive an 'old- style' benefit, then you an expect to be moved to universal credit at some point in the near future.

- The government plans to move everyone who currently received old- style benefits

onto universal credit by the end of 2025/26 - When you get your "Move to Universal Credit" invitation letter from the DWP make sure you move across before the deadline date, and speak to your housing officer or property manager.

Support with changing to Universal Credit

- Universal Credit claims can be managed online OR via a telephone claim. Choose the one which will suit you better

- Most Universal Credit claims are online and you can claim from here: Universal Credit online

- If you know you will struggle to manage your claim via an online account, you can make a claim by phone on 0800 328 5644.

- Citizens Advice has a dedicated Help to Claim service. Their helpline number is 0800 144 8444 and further information on the service can be found here: Find out about claiming Universal Credit on the Citizens Advice website.

- Guidance video on claiming Universal Credit available here: Understanding Universal Credit - How to claim.

FAQs

Housing Benefit: Give your local council a copy of your rent increase letter. You can usually do this online or at council offices. You can report changes as soon as you receive the letter.

Universal Credit: Report changes through your Universal Credit account (online or by phone). You can only report rent changes from the day they take effect.

Eligible for Housing Benefit/Universal Credit:

- Communal services like lifts, entry doors, gardening, cleaning shared areas

NOT eligible for Housing Benefit/Universal Credit:

- Personal services like heating/hot water to your home, meals, laundry, personal care, personal alarms

You must pay for services not eligible yourself.

Housing Benefit: Check your benefit letter or contact your borough benefits team directly.

Write in your Universal Credit claim journal that you want them to pay rent directly to us. You can also tell your housing officer you'd like this arrangement.